Surpassed US market expectations by 2%

China is concerned about deflation due to the real estate slump

The U.S. stock market is at its highest every day, while China’s plummets.

“China’s economy will find it difficult to overtake the U.S.”

《US wins economic war with China

Not long ago, it was almost considered a foregone conclusion that China’s economic size would soon overtake the United States. However, recently, while the United States, armed with technological innovation, is showing rapid economic growth, China’s economic slowdown is prolonged, leading to analysis that the United States has won the ‘G2 economic war’. The U.S. growth rate for the fourth quarter of last year (October to December), announced on the 25th (local time), was 3.3%, far exceeding market expectations.》

As the United States showed an economic growth rate that exceeded market expectations in the fourth quarter of last year (October to December), there is an assessment that the United States has won the economic war between the United States and China. While expectations for the U.S. economy to become ‘Goldilocks’ (an ideal economic situation that is neither hot nor cold) are growing, concerns about deflation (falling prices during an economic recession) are growing in the Chinese economy due to a real estate recession and a decline in consumption. Some predict that it will be difficult for the Chinese economy to overtake the U.S. economy in the future.

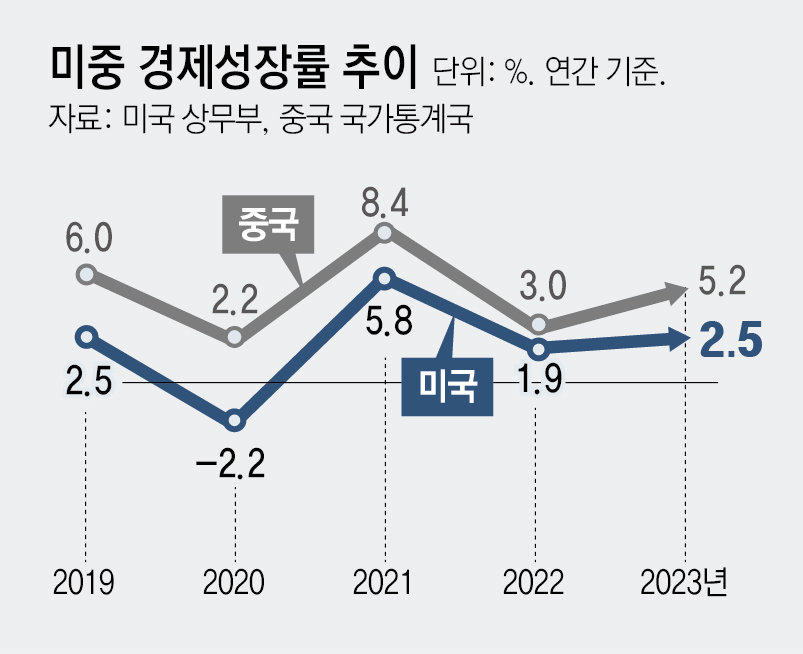

On the 25th (local time), the U.S. Department of Commerce announced that the U.S. gross domestic product (GDP) increased by 3.3% in the fourth quarter of last year. Although it was less than the 4.9% in the third quarter of last year (July to September), it significantly exceeded the market average estimate of 2.0%. Last year’s annual GDP growth rate was 2.5%, 0.6 percentage points higher than 2022 (1.9%). Despite intense austerity measures, consumer spending has steadily increased, and government spending and private investment have also increased, leading to an economic upturn.

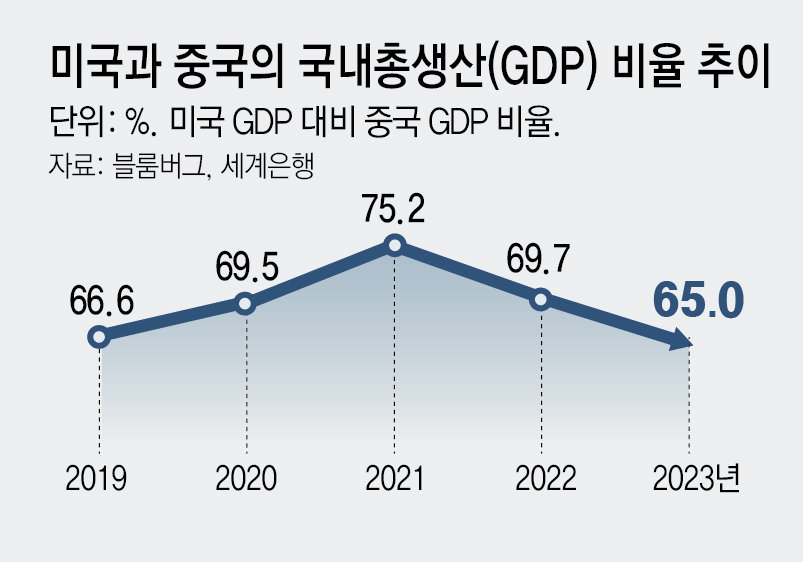

China’s economy also grew by 5.2% last year, but the gap with the United States is widening. In 2021, China’s GDP reached 75.2% of the US GDP, closely following the size of the US economy, but fell back to 65.0% last year. As the new coronavirus infection (COVID-19) spread again in early 2022, the aftereffects of blocking major regions such as Shanghai (‘Zero Corona’ policy) were significant. Bloomberg analyzed on this day that the U.S. nominal GDP last year increased by 6.3% compared to the previous year, surpassing China’s (4.6%), and that “the recovery of the U.S. economy after the economic crisis caused by COVID-19 has been shown to be better than that of China.”

Even in the stock market, the light and dark sides of the two countries are starkly different. The U.S. stock market is soaring every day based on the technological innovations of the seven large technology stocks (Apple, Alphabet, Amazon, Meta, Microsoft, Nvidia, and Tesla), also known as the ‘Magnificent 7 (M7)’. there is. The Standard & Poor’s (S&P) 500 Index broke its all-time high for five consecutive trading days from the 18th to the 25th. The Dow Jones Industrial Average also hit an all-time high again in three days.

However, China’s stock market plummeted as real estate companies such as real estate developer Biguiyuan (碧桂園, Country Garden) and Hengda Group were on the verge of default. The Hong Kong H Index, calculated by selecting 50 Chinese companies listed on the Hong Kong stock market, fell to the 5,300 level. As of early 2021, it had exceeded 10,000, but it was cut in half in just three years. Last year, foreign investors and others left the Chinese stock market, resulting in a net outflow of capital for the first time in five years.

Experts pointed out that while in the United States, technological innovation by big tech companies continues and consumption increases despite the high interest rate environment, China is unable to overcome the real estate crisis that has continued for several years and the U.S.-led supply chain reorganization offensive. In particular, some analyzes say that the differences have widened as the economic policies of the two countries diverge after COVID-19. The United States has increased jobs by protecting its own industries and attracting global companies, but China has implemented high-intensity quarantine policies such as regional blockades and the Communist Party, including President Xi Jinping, has exercised repressive power, encouraging the departure of foreign capital. In China, local debt has increased due to the real estate recession and a deflation crisis has occurred, and there is a gloomy outlook that recovery will be difficult for the time being.

Geun Lee, Distinguished Professor of Economics at Seoul National University, said, “There was talk that China would overtake the United States in terms of GDP in the mid-2030s, but this will have to be delayed by 20 to 30 years.” He added, “It may not be possible to overtake forever.”

Source: Donga

Mark Jones is a world traveler and journalist for News Rebeat. With a curious mind and a love of adventure, Mark brings a unique perspective to the latest global events and provides in-depth and thought-provoking coverage of the world at large.