Japan’s first quarter growth rate also turned positive

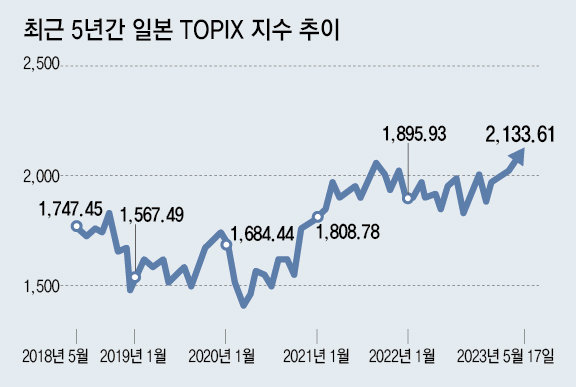

The Japanese economy, which has been referred to as the ‘lost 30 years’ because it has not escaped the slump despite massive amounts of money from Abenomics, has recently been on the rise. The Nikkei average stock price, which is calculated from the top 225 stocks listed on the Tokyo Stock Exchange, exceeded 30,000 yen in 1 year and 8 months, and the TOPIX index covering all stocks in the first section of the Tokyo Stock Exchange has been on the rise since the ‘bubble economy’ began to dissipate. It reached a new high in 33 years. In the first quarter of this year (January to March), Japan’s economic growth rate turned positive for the first time in three quarters. However, there are observations that the recovery of growth will be limited if it does not get out of the lagging digitalization and long-lasting low birth rate and aging population.

According to the Tokyo Stock Exchange on the 17th, Japan’s TOPIX index reached 2,127.18 the previous day, the highest since August 1990, and closed at 2,133.61, up 0.3% on the same day. The Nikkei Stock Average closed at 30,93.59 yen, up 0.84%. The Nihon Keizai Shimbun said, “Amidst concerns about economic downturn in the United States and Europe, funds are flowing into Japan, where expectations for economic recovery after Corona 19 are high. Various indicators are also confirming the perceived recovery of the economy.”

The U.S. suffers from sluggish negotiations on raising the federal government’s debt ceiling and concerns over economic deterioration. In Korea, the operating profit of listed companies in the first quarter of this year decreased by less than half from a year ago, but Japan is different. SMBC Nikko Securities analyzed and predicted the performance of 1308 listed companies last year, and as a result, sales increased by 14.2% and operating profit by 4.2%.

Warren Buffett’s Berkshire Hathaway, an ‘investment guru’, sold all of its shares in TSMC, a Taiwanese semiconductor company, and invested more than $6 billion (approximately 8 trillion won) in Japan’s top five general trading companies, including Mitsubishi. As the price of energy and agricultural products skyrocketed due to the protracted war in Ukraine, stock prices of Japanese general trading companies that are strong in developing raw materials and trading agricultural products are at the highest level every day. Chairman Buffett said, “Japanese general trading companies are companies that will survive forever.”

Japan’s economic recovery is also reflected in its economic growth rate. According to the Japanese Cabinet Office, Japan’s real gross domestic product (GDP) in the first quarter of this year increased by 0.4% from the previous quarter, turning positive in three quarters.

The economy is improving thanks to an increase in personal consumption and an increase in facility and public sector investment. The increase in foreign tourists due to the elimination of quarantine for Corona 19 also had an effect. Japan’s average wage increase rate this year was 3.67 percent, the highest since 1993, which was also a positive factor for the economy.

Sayuri Shirai, professor of economics at Keio University, said, “Consumption of durable goods such as automobiles and home appliances has increased, and consumption in the service sector, including tourism, has also increased. “Capital investment is continuing in the digital and carbon neutral fields,” he analyzed the cause of the economic improvement.

It is unclear whether the Japanese economy will lead to full-fledged growth. Its dependence on foreign markets is not as high as that of Korea, but its current account surplus (9.2 trillion yen) last year was only half of the year before due to sluggish exports. Although the income balance is in the black thanks to investment interest and dividends, the export structure of high value-added products is getting weaker. The national debt, which stood at 1,029 trillion yen (about 1.66 trillion won) as of the end of last year, is also a burden.

Professor Shirai said, “Japan’s potential growth rate is only 0.5%, and consumption is not increasing significantly (although it has increased) due to the aging population. (The stock price is on the rise), but it is unclear whether wages will continue to rise, so corporate profits need to be improved.”

Tokyo =

Source: Donga

Mark Jones is a world traveler and journalist for News Rebeat. With a curious mind and a love of adventure, Mark brings a unique perspective to the latest global events and provides in-depth and thought-provoking coverage of the world at large.