Court: Board of directors controlled by Musk

“I can’t properly prove the reason for the large amount of compensation.”

If defeat is confirmed, there is a risk of spitting out 75 trillion won.

Musk announces appeal for “autonomous decision”

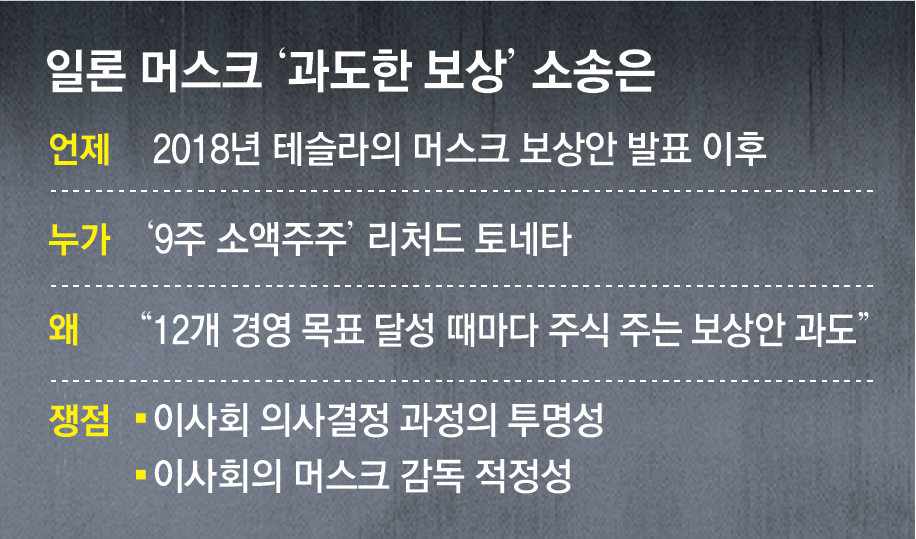

Tesla CEO Elon Musk, the world’s richest man, is at risk of losing about $55.8 billion (about 74.5 trillion won) in Tesla stock due to a lawsuit filed by minority shareholders. This is because the U.S. court in Delaware, the first trial, sided with minority shareholders on the 30th of last month, saying that Musk had secured the stocks in accordance with the compensation package improperly established by the Tesla board controlled by Musk.

This stock played a significant role in Musk becoming the world’s richest person. Accordingly, Bloomberg News predicted, “If these stocks are taken away, Musk could fall to the third richest person in the world.” In addition, the New York Times (NYT) and others diagnosed that this could also sound an alarm for other companies that provided enormous compensation packages to their CEOs. Pressure across society is also expected to increase for corporate boards to stop acting as CEOs’ ‘hands-on’ and put the brakes on the arbitrary management of specific CEOs.

Delaware State Court Judge Kathleen McCormick ruled on this day that the defendant Tesla failed to properly prove why it paid such compensation to CEO Musk and that “the board’s compensation decision process was flawed.” In particular, he pointed out that Musk’s younger brother, people who owe money to Musk, are on Tesla’s board of directors, and that other board members also have a ‘strong relationship’ with Musk.

The compensation plan passed at Tesla’s general shareholders’ meeting in 2018 mainly provides Musk with a stock option worth about 1% of Tesla stock whenever he achieves 12 specific goals, including sales and market capitalization. Musk achieved all of his goals in 2022, four years later, and received $55.8 billion worth of stock.

Richard Tornetta, a minority shareholder who owned 9 Tesla shares in 2018, filed a lawsuit in October 2022, saying this compensation plan was unacceptable. He argued that this compensation plan was unprecedentedly high in history, that Musk pressured the board of directors to approve this compensation plan, and that Tesla also failed to disclose important information to shareholders.

In particular, Mr. Tonetta objected, saying, “Shareholders were not told that Musk personally created his own compensation plan or that board members were subordinate to Musk.” This means that the board of directors controlled by Musk compensated Musk as he wanted, but shareholders were completely unaware of it.

After Musk sold Tesla shares at the end of 2022 and acquired Twitter (now Mr. Tonetta claimed that Musk had been neglecting Tesla by focusing on Twitter while Tesla’s management was in crisis due to intensifying competition in the electric vehicle industry.

In his ruling, Judge McCormick ruled that Tesla’s board of directors’ decisions were under Musk’s influence, saying, “Musk exercised the maximum influence that a manager can have over the company.” In the past, he was in charge of the trial when Musk filed a lawsuit against Twitter over his intention to withdraw his acquisition of Twitter.

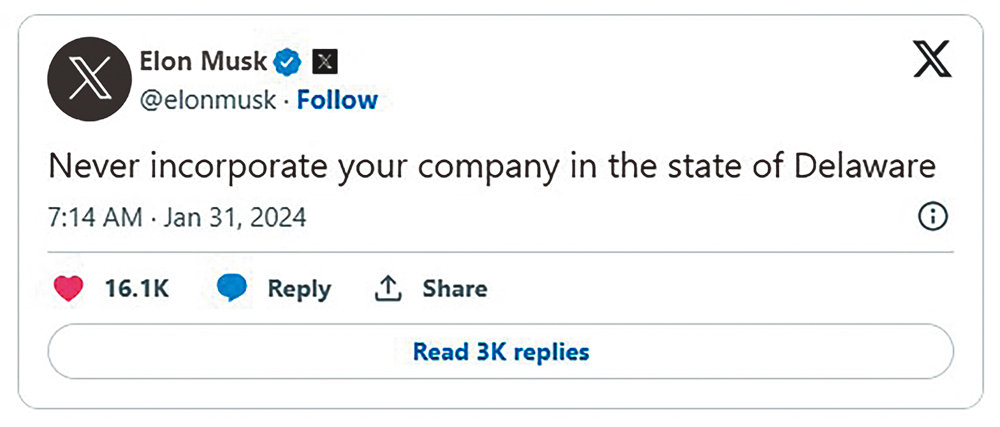

View largerA message posted by Tesla CEO Elon Musk on Musk

View largerA message posted by Tesla CEO Elon Musk on MuskAfter the ruling, Musk protested through his He also poured out posts such as “Should Tesla move to Texas, where its actual headquarters are located?” Tesla Corporation is registered in Delaware, a state with low corporate tax, but its headquarters factory is located in Texas.

From the beginning of this trial, he insisted on the legitimacy of his compensation, saying that it was made based on the autonomous decision of the board of directors. He claims that it is all his credit that Tesla’s sales and market capitalization have increased, as well as that Tesla has had a significant impact on various fields around the world beyond the electric vehicle industry.

If Musk loses in the appeals court, Tesla may have to offer him a lower compensation offer than the $55.8 billion offer. A decline in Musk’s asset value may follow. Musk’s goal of increasing Tesla’s stake from the current 13% to 25% is also likely to be disrupted.

New York =

Source: Donga

Mark Jones is a world traveler and journalist for News Rebeat. With a curious mind and a love of adventure, Mark brings a unique perspective to the latest global events and provides in-depth and thought-provoking coverage of the world at large.